How to manage cash flow during the coronavirus crisis

Creating a cash flow forecast can help agents analyse their costs and decide where to make cutbacks, says David Moon, head of business development at Advantage Travel Partnership

Turnover is vanity. Cash is sanity.

Never has this saying been more relevant. In today’s business world, cash really is king and ensuring you are managing your cash flow carefully is going to be critical.

Cash flow is the amount of cash a business has available to them at any given time and is a result of the inflow and outflow of money. Cash flow should not be confused with profit. For travel agents, it is important to separate out any monies that are due to suppliers and the monies you retain as commission.

With a squeeze at both ends – fewer new bookings, cancelled bookings, amended bookings – travel businesses are under tremendous pressure. So, what can you do about it?

Tips for cash flow forecasting

You’ll need to manage your cash flow carefully in order to head off or deal with any potential cash shortfalls further down the line.

The best way to do this is to put together a cash flow forecast. It might sound obvious, however not all small to medium-sized business undertake regular cash flow forecasting and if that is the case for you, now is a really good time to start.

To get started, you’ll need to compile a list of your monthly business outgoings. This will typically include rent, rates, salaries, utilities, insurances and other costs. These may vary by month so doing a cash flow forecast by month for the next 12 months is important.

You’ll then need to forecast what your cash inflows will be over the same period. Travel normally has peaks and troughs of when commission is realised. At the moment, cash inflows for most travel businesses are going to be minimal. Once things start to ease and more countries open their borders, bookings will start to increase.

You’ll need to consider that for bookings which are cancelled and for which a refund is due to your customer, you will be receiving the net amount back from the tour operator and you will need to top this up to the gross amount that’s due to the customer.

It is critical that your forecasting is as accurate and realistic as possible. Over-forecasting cash inflows will cause a problem, so be honest with yourself and consider how realistic your numbers are. You may consider preparing more than one cash flow forecast based on several scenarios.

Having established your costs, you’ll need to add in your “opening balance”. The opening balance on your forecast is the amount of cash your business has available to it now in order to meet its obligations.

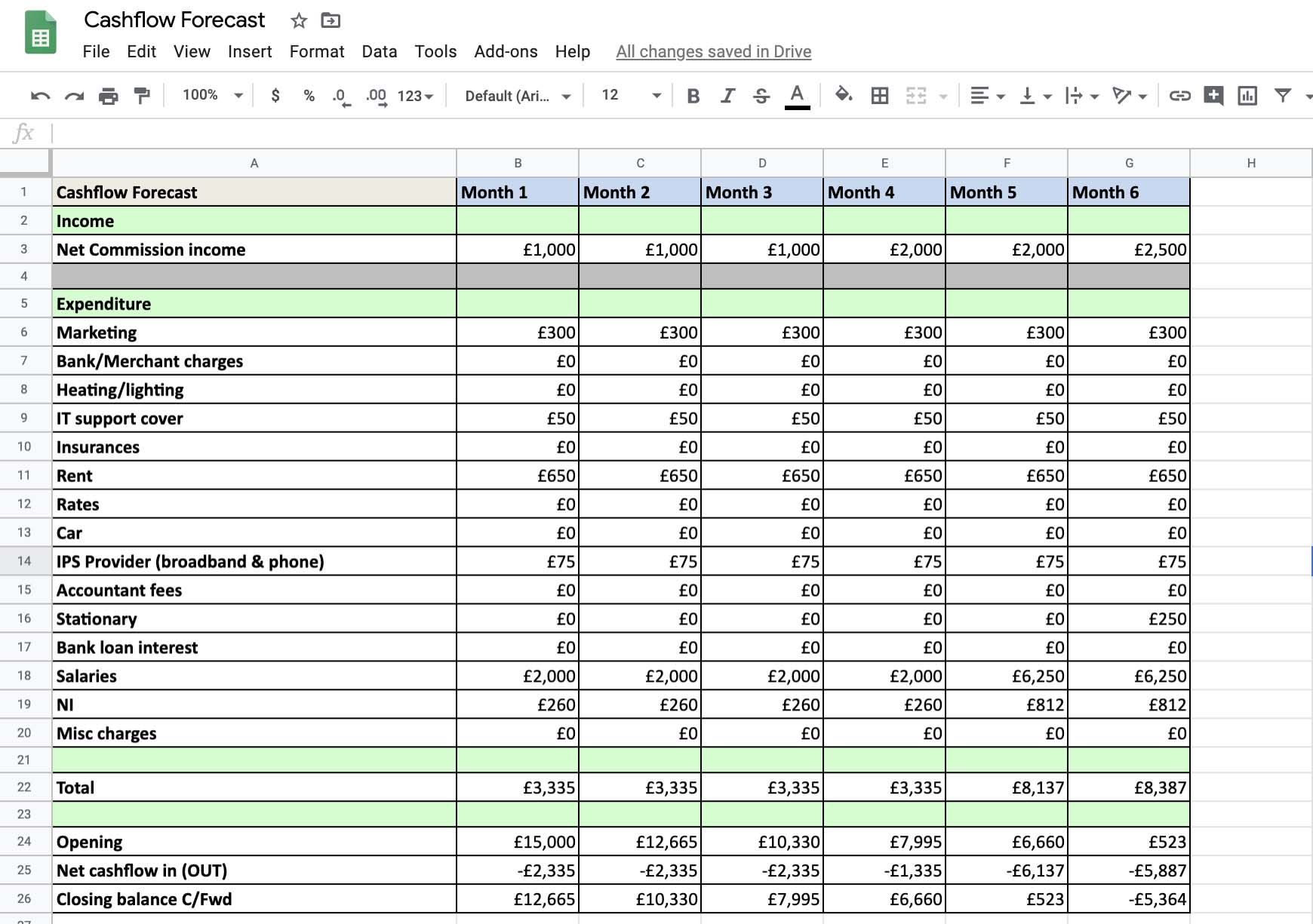

Cash flow forecasts work best when using a spreadsheet such as Microsoft Excel, as this will allow you to adjust your numbers and the forecast will automatically update. Your cash flow forecast may look something like this:

For this example, we can see that in month six, the closing balance is negative, meaning the business will have run out of cash. The continuation of its costs being higher than its cash inflows has eaten away at its opening balance.

What is your closing balance telling you?

Your closing balance is going to tell you how much cash you have available in the business to meets its obligations. If this figure is positive, that’s great. If it is a negative figure, then you will need to consider increasing your cash inflows or reducing your outgoings.

At present, increasing cash inflows may be difficult so you will be most likely having to concentrate on cutting costs or seeking a cash injection.

Government support

To assist businesses through these difficult times, the government has put in place a range of measures to assist businesses.

One of these is the Job Retention Scheme (JRS), which involves furloughing staff. This is where the government will fund 80% of a staff member’s salary up to a maximum of £2,500 per month. However, remember you will need to pay this out in advance of making a claim from government, so you will need to factor this in to your cash flow forecast.

There are also grants and loan options available. If you think you may need access to a government-backed loan, start preparing now. Do not leave it until the last minute in case your application takes longer than you think.

There is uncertainty as to how long the current situation is going to last and how quickly the market is likely to bounce back, so it may be prudent to apply for a loan so that you have a buffer. You will need a cash flow forecast if applying for a loan.

You may need to consider investing personal money into the business in order to keep the company trading.

On the cost side, speak to your landlord regarding a rent-free period. Look around for a better deal on your utilities and cut any unnecessary expenditure.

Agent insight

Mark Johnson, director at Advantage member agency Polka Dot Travel, on how it is currently managing cashflow:

“These are without doubt unprecedented times for the industry and no rule book has been written on how to deal with this crisis.

"The problem we all have is nobody knows how long the situation is going to last and when life as we know it will return to normal. We are planning ahead and ensuring we have the cash reserves in place to cover the next 12 months.

"We are doing this by concentrating on reducing our burn rate each month, striking deals with landlords to spread the payment out and speaking to any supplier where we have fixed costs each month, i.e. printers, telephones and computers. Every little detail is being looked into to ensure that the monthly outgoings are kept to a minimum.

"At this moment in time I feel it is hugely important to work closely with your accountants. We are very fortunate and have a fantastic relationship with ours and they are helping tremendously in looking at our numbers and ensuring that we are fully aware of all the government help that is out there.

"Options that we are looking at include furloughing staff, grant schemes that are simple and quick to apply for, the Coronavirus Business Interruption Loan Scheme and VAT deferral.

"This is a time to be proactive and ensure that you have planned and made the necessary actions to counteract the reduced income that we are all experiencing at the moment.”