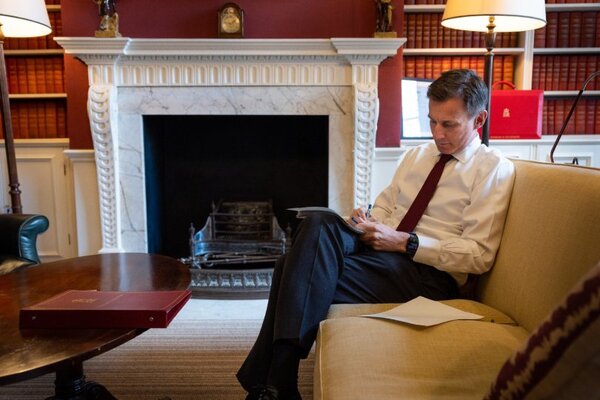

Seven key talking points for travel from Jeremy Hunt's spring Budget

Gary Noakes

Gary NoakesChancellor Jeremy Hunt has confirmed fresh help with household energy costs, childcare, and small business investments in his spring Budget, but did not give any business rate relief or assistance for businesses struggling with inflation pressures.

Hunt told the Commons the UK would see inflation tumble but avoid technical recession this year, but admitted the economy would still contract.

In his previous autumn statement, the chancellor opted to extend business rates relief to 75% for eligible businesses. This helped the high street, but not those without retail premises – something Abta had hoped for from Hunt this time.

The Budget also failed to address the Advantage Travel Partnership’s call for business rates reform.

So what do Wednesday’s announcements mean for travel?

What is the big picture?

Inflation is forecast to fall from a high of 10.7% last year to 2.9% by the end of this year, and according to the independent Office for Budget Responsibility, the UK will technically avoid a recession.

The OBR forecasts a 0.02% contraction of the economy this year, but growth of 1.8% in 2024. Unemployment is forecast to rise by less than one percentage point to 4.7%.

Help with energy costs

Households will receive another three months’ cap on their energy bill costs after Hunt confirmed the cap would be extended until June. The Energy Price Guarantee, which typically limits an annual household bill to £2,500, was due to rise to £3,000 at the end of April.

However, the additional £400 winter discount – currently paid in six monthly instalments of £66 and £67 – will cease in April. The Treasury said extending the guarantee would save the average household £160. Energy bills are also likely to fall from July because of the drop in wholesale energy prices.

Boost for working parents

Hunt’s other big news was a £4 billion expansion of 30 hours free childcare to working parents with one- and two-year-olds in England, but the support won’t come in its entirety until autumn 2025.

Hunt said: “I don’t want any parent with a child under five to be prevented from working if they want to, because it’s damaging to our economy and unfair mainly to women.

"So today I announce that in eligible households where all adults are working at least 16 hours, we will introduce 30 hours of free childcare – not just for three and four-year-olds, but for every single child over the age of nine months."

Hunt continued: "The 30-hour offer will now start from the moment maternity or paternity leave ends. It’s a package worth, on average, £6,500 every year for a family with a two-year-old child using 35 hours of childcare every week, reducing their childcare costs by nearly 60%.”

Working parents of two-year-olds will be able to access 15 hours of free childcare from April 2024. From September 2024, that 15 hours will be extended to all children from nine months up. From September 2025, every working parent of under-fives will have access to 30 hours free childcare per week.

Other care and jobs support

Hunt also said a third of primary schools did not currently offer "wraparound care" and that the government would therefore fund schools and local authorities to increase this so all children would be looked after at schools between 8am and 6pm. However, he only said this was “an ambition”, with a target date of September 2026.

More measures to help the sick and disabled return to work were confirmed, with Hunt estimating the UK could “fill half its vacancies” if people were allowed to use video conferencing and flexible working.

What about tax and pensions?

Corporation tax, the tax companies pay on profits of more than £250,000, has increased from 19% to 25%. The average in Europe, according to the Tax Foundation, is 21.5%, with the worldwide average being 23.4%.

Smaller businesses will have their Annual Investment Allowance increased to £1 million. Hunt said the new policy of “full capital expensing” meant money spent on “IT, plant and machinery”, could be deducted “in full and immediately” from taxable profits. The policy will apply for the next three years.

One of Hunt’s measures to get the over-50s back to work is to abolish the maximum annual tax-free allowance payable into a pension pot from just over £1 million and raising the annual tax-free allowance from £40,000 to £60,000.

This, though, will likely only have a minimal impact on travel, as only top earners can afford to put anything like this amount into their pensions – and there are very few of those in the travel industry.

The planned 11p rise in fuel duty will be frozen for 12 months, while the 5p cut will remain.

Investment

Twelve new "investment zones" in West Midlands, Greater Manchester, the North East, South Yorkshire, West Yorkshire, East Midlands, Teesside and Liverpool will be created, together with one each in Scotland, Wales and Northern Ireland.

Another £400 million of levelling up funding will be paid to areas including Rochdale and South Tyneside. Edinburgh’s festivals will receive “up to” £8.6 million.

Anything for the environment?

Measures to reduce carbon emissions may have spin-offs for the travel industry’s ambitions to develop sustainable fuels.

Hunt announced £20 billion of support “for the early development of carbon capture, usage and storage of 20-30 million tonnes of CO2 per year by 2030”.

He also said he would extend the Climate Change Agreement scheme for two years to allow eligible businesses £60 million of tax relief on energy efficiency measures.

Sign up for weekday travel news and analysis straight to your inbox

Gary Noakes

Supplier Directory

Find contacts for 260+ travel suppliers. Type name, company or destination.