How hedging has put the brakes on holiday price cuts

Edward Robertson

Edward RobertsonFalling oil prices and a weakening euro should be leading to a fall in holiday prices - or should they? Edward Robertson looks at why prices are likely to remain steady, despite headlines shouting otherwise

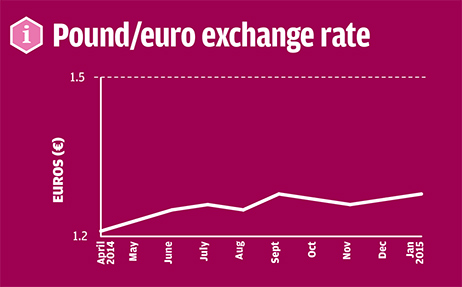

This week, a single pound will buy you €1.29. And while the pound strengthens against a struggling euro, the continued drop in oil has pushed the price of a barrel of Brent crude to a six-year low of $47.36.

We’ve been here before, and it’s a good place to be. But that’s not to say there aren’t inherent problems in the situation.

Already journalists are putting two and two together, making five, and writing stories about how holidays in 2015 will be the cheapest for years. Customers then turn to travel agents, brandishing the headlines and demanding large discounts on their summer holiday.

Agents are suddenly the bad guys, as they attempt to explain that while the average selling price of a seven-day trip is around 2.5% down this year, consumers are unlikely to see the big discounts the national press predicts.

"Most operators will have hedged a huge amount of euros for this summer and we’re looking foolish"

John Tangney, chairman of Aito’s aviation committee, says the biggest factor stopping summer 2015 prices from being hugely discounted is hedging, with operators and airlines buying both currency and fuel many months in advance.

He adds that his own company, Tangney Tours, has hedged 50% of its currency for the summer season - a move he made last summer when the value of the pound hovered around the €1.25 mark; good, but not as good as today.

“I don’t think there’ll be a lot of savings showing through for the summer, for the client spending money,” he says. “Most operators will have hedged a huge amount of euros for this summer and we’re looking foolish, but then again you never know.”

Last year’s deals

Meanwhile, Tangney explains that much of the contracting on hotels will have been done last summer when the euro was stronger against the pound than it is today.

He believes canny agents may find better pricing in the dynamic packaging market, where both hedging and contracting can be more fluid. However, Tangney also urges agents to remember the advantages of such widespread hedging in the industry, adding: “Agents have got to be positive and remember that we haven’t seen any surcharges for a very long time from the tour operators, and that’s because they’ll have carefully brought forwards their cover [by hedging].

“If we hadn’t bought our euros in advance we could be dropping prices by 4% or 5% but it’s far better than putting prices up by 4% or 5% if the pound went down. Stability in the market is what families want.”

Tangney argues that if prices remain as they are for a while then the industry will still see some big benefits.

“This year the prices are going to be higher than they could have been, but we’ll see some very good savings for 2016,” he says.

He adds that the best deals could be available via smaller operators which do not hedge as far in advance as giants such as Tui and Thomas Cook, meaning they can react far quicker to fluctuations in the market.

Indeed, a spokesperson for Cook confirmed the company typically hedges up to 18 months in advance for fuel, although he was also keen to highlight the advantages this can bring.

“Like many airlines, we contract for fuel in advance to ensure we can give price certainty to our customers and offer competitively priced holidays and flights, sometimes more than a year before they want to travel.”

Thomson follows a similar hedging policy, with a spokesperson insisting that “unpredictable or short-term variations in the cost of fuel have a very small effect on current prices due to the volume of fuel that has already been purchased”.

"The euro will have an impact but there’s still capacity, demand and market competition. All those things will affect price"

Monarch Travel Group sales director Gary Anslow agrees that hedging has prevented prices from being slashed in response to recent economic factors, as well as a number of other factors.

“It is overly simplistic to say a drop in the exchange rate will lead to a price reduction of X amount,” he says.

“The purpose of hedging is to absorb those bumps and that clearly makes a difference. That’s the whole point of hedging - when the price spikes we absorb it and when it drops we can take it [any previous losses] back.

“We will be getting an element of benefit from contracting and that gets us a bit more flexibility on our pricing.

“The euro will have an impact on some of the cost but there’s still capacity, demand and market competition. All those things will affect the holiday price as much as anything else.”

Anslow argues that traditional European markets for the Mediterranean, such as France and Germany, will be hurting more now as the continent continues to struggle. He also suggests that holidaymakers from these countries could be hit more than the British market should they try to travel outside the eurozone.

Unknown factors

But again, factors beyond the control of UK operators mean it is simply too naive to suggest that summer 2015 will be a pricing bonanza.

“There might be excess capacity which drives prices down, but at the same time something else in the market might well happen,” Anslow argues.

“We’ve all got the experience of the Canaries being full because of Egypt. We can’t predict the socio-political factors that influence the market.”

Sunvil chairman Noel Josephides agrees that hedging a year in advance, especially on the fuel front, means that sudden discounting is unlikely to occur.

But he is keen to remind agents that they have been reaping the benefits of the hedging practice for the past few years, particularly with the demise of the fuel surcharge.

“We do not want to take the risk of fuel prices being out of control, we do that because we don’t want to go out of business,” he explains.

“We don’t want the hassle of fuel surcharges. When it is going up and up, we have no surcharges. Now when it goes down there’s not much we can do; we can’t turn around and say it should be less.”

Josephides agrees however that if the current situation remains as it is, 2016 is likely to see a fall in pricing, with seats on a standard Greek charter airline potentially falling by between £15 and £18 a seat.

In-resort gains in the eurozone

While it may have little impact on today’s holiday prices, a tumbling euro is good news for customers in resort, but agents must be wary of selling fool’s gold.

Research by the Post Office shows that of all the destinations in the top 20 in this year’s Holiday Money Report 2014/15, six are in the eurozone.

The barometer measures the price of a number of items typically bought in resort, from a bottle of beer or a glass of wine to a packet of cigarettes and suncream.

And it shows Portugal’s Algarve is the second cheapest place to pick up the goods, costing £36.04, while the same items in Spain’s Costa del Sol cost £36.80, putting it in fourth place.

Crete comes seventh at £43.71, Paphos is ninth at £43.71, Corfu is 14th at £53.87 and Sliema in Malta is 18th at £57.63.

Head of Post Office Travel Money Andrew Brown says: “Conversely, the pound is currently worth nearly 6% more against the euro than a year ago and has kept at high levels for much of the past year. That could change because exchange rates are unpredictable.”

The Monarch Travel Group sales director Gary Anslow agrees that at the current rates, customers will enjoy the benefits of the euro’s recent fall against the pound in resort.

But Sunvil chairman Noel Josephides warns: “Let’s not give people too much [hope on the euro], we’ve got an election in May and the German and French economies are both beginning to perform a bit better.

“By the time everyone goes on holiday there’s no guarantee the pound will be around the €1.25/€1.26 mark. May is a long time away.”

Sign up for weekday travel news and analysis straight to your inbox

Edward Robertson

Supplier Directory

Find contacts for 260+ travel suppliers. Type name, company or destination.