Travel staging 'remarkable recovery' despite economic headwinds

Debbie Ward

Debbie WardTravel is largely facing off headwinds from squeezed disposable incomes as it bounces back but the industry should be alert to coming challenges, says the latest WTM Global Travel Report.

Worldwide travel is continuing its “remarkable recovery” despite mounting economic pressures, but the boom is expected to slow as pent-up demand becomes largely satisfied.

This is among key messages from this year’s WTM Global Travel Report, in association with Tourism Economics, which uses data from nearly 200 countries worldwide to predict trends in traveller behaviour.

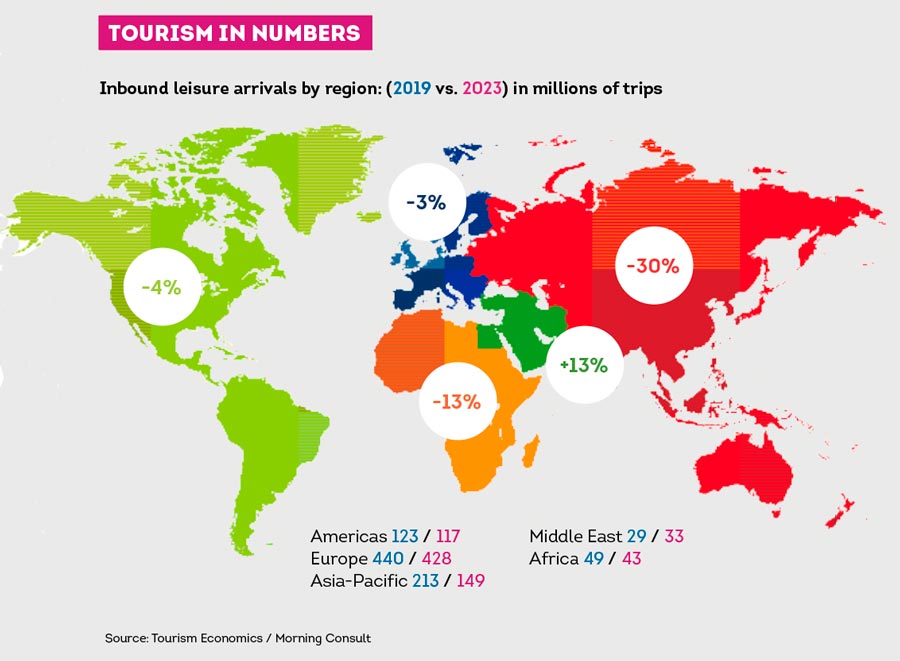

Despite economic difficulties, due in part to global supply problems, international trips in 2023 should exceed 1.26 billion, equivalent to 86% of demand in 2019, with leisure recovering more strongly than business travel.

Globally, leisure travel is just 10% lower than 2019 levels. The Middle East, aided by some major events, is expected to excel, ending the year 13% up on 2019. By contrast Asia-Pacific, which reopened later, is projected to be 30% down.

However, the continuing pace of worldwide growth is expected to slow as leisure travel volumes reach pre-pandemic levels.

INCREASED SPENDING

Travellers are spending more than pre-Covid in most regions, partly due to higher prices, including for fuel.

Most significantly, they are continuing to prioritise holiday spending.

So far undeterred by rising costs, the travel share of spend has regained 2019 levels among advanced economies and is continuing upwards in developing markets. Helped by high employment, even lower income households are not significantly reducing travel, though greater polarisation is expected between luxury and budget demand.

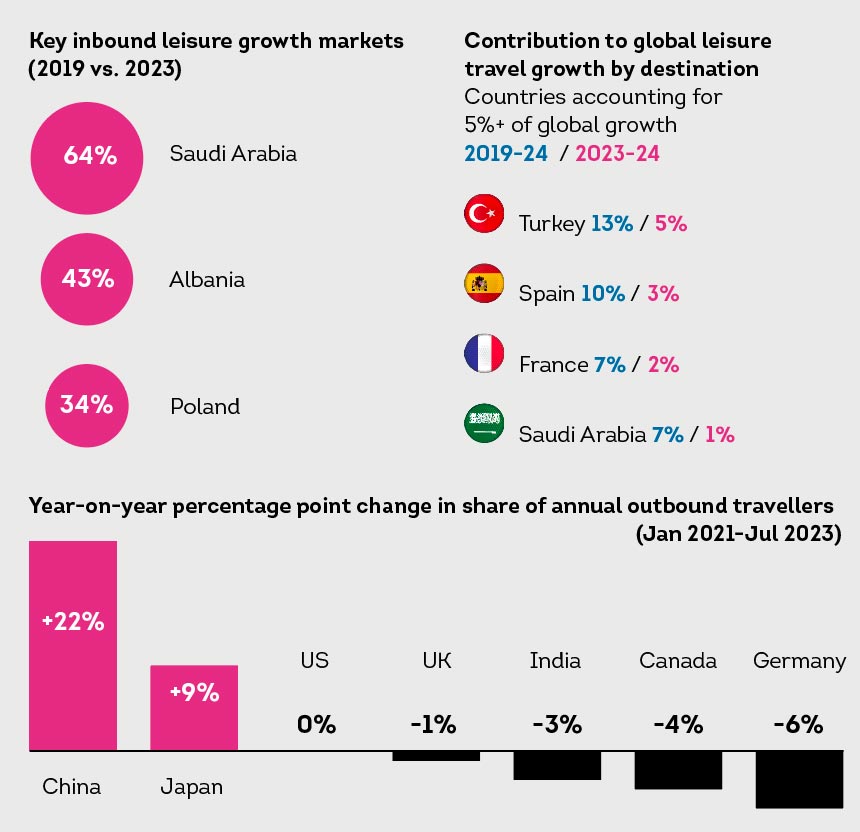

Most destinations are expected to see nominally increased inbound tourism expenditure in 2024 compared with 2019. Europe’s largest inbound markets – Spain, France and Turkey – are particular winners, set to account for 30% of the incremental global travel spend between 2019 and 2024.

Meanwhile Asia-Pacific, due to its later opening (and the further delay from the important source market of China), is most significantly lagging behind and still rebuilding capacity, though “recovering strongly” the report says. India and South Korea are bright spots, almost level with 2019.

The ranking of top destinations is set to remain largely unchanged from 2019. However, the smaller markets of Albania, Croatia and the Maldives are seeing significant post-pandemic growth, expected to be up by more than 50% by 2024 compared to pre-pandemic. Increased connectivity to key source markets and prioritisation of tourism are bolstering their prospects.

Due to increased links, China is expected to more than double its inbound tourism spend between 2024 and 2033. Saudi Arabia, Egypt, and South Africa should follow suit, thanks to continued investment in tourism infrastructure.

FORECAST FACTORS

Significant increases in outbound travel are predicted from India and Indonesia, and most particularly China, where the proportion of households able to afford international travel is predicted to double over the next decade. Nearby Thailand and Japan are likely to especially benefit.

There are, however, global risk factors to growth. Worldwide, the proportion of people over 65 will nearly double by 2050, affecting the kind of destinations and activities that will be in demand.

Continued high jet fuel prices and the need to develop sustainable aviation fuels will impact affordability.

Calls for more sustainable travel are meanwhile increasing demand for “slow travel” – taking fewer but longer trips. The effects of climate change, such as wildfires and flooding, could also cause shifts in tourism seasonality.

The WTM Global Travel Report will be released in full, with its findings discussed on the Elevate Stage, from 14:00-15:30 on Monday 6 November.

Sign up for weekday travel news and analysis straight to your inbox

Debbie Ward

Supplier Directory

Find contacts for 260+ travel suppliers. Type name, company or destination.