Budget 2024: everything agents need to know

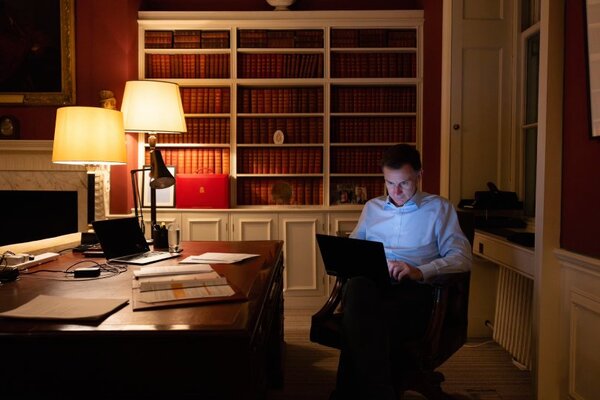

Gary Noakes

Gary NoakesAn increase in Air Passenger Duty (APD) for business class passengers and a cut in National Insurance are among the key takeaways for the travel industry from the government’s spring Budget.

Chancellor Jeremy Hunt did not specify the rate of APD increase, but told the Commons it would fall “on non-economy” ticket sales “to accommodate for high inflation in recent years”.

Treasury documents do not specify the increase, but say it will raise an extra £110 million next year (2025/26), plus a further £10 million a year for each year after that through to 2028/29.

The Treasury said: “The 2025/26 APD rates for economy passengers will increase in line with forecast RPI [Retail Price Index], rounded to the nearest pound.

“Rates for those flying premium economy, business and first class, and for private jet passengers, will also increase by forecast RPI and will be further adjusted for recent high inflation to help maintain their real-terms value.”

Virgin Atlantic estimated the change would increase long-haul business APD rates by 12%.

Hunt also confirmed a cut in National Insurance from 6 April for both the employed and self-employed.

Rates will fall to 8% for the employed and to 6% for the self-employed. Hunt said this meant employees would benefit by £450 a year and the self-employed by £350.

He claimed: “The average earner in the UK has the lowest effective tax rate since 1975.”

Abta said it was yet to be seen whether the measure would line people’s pockets sufficiently to create a new "feelgood factor" that would drive bookings.

Other industry leaders, meanwhile, described the Budget as a "missed opportunity", one that failed to create a new tax-free shopping scheme for travellers and placed additional burdens on aviation.

Loan scheme extension

In other measures, the chancellor said he would abolish tax relief on furnished holiday lettings, as they had an impact on the rental sector available to local populations.

Hunt also announced an increase in the VAT registration threshold for small businesses from £85,000 to £90,000, the first rise in seven years.

In another announcement to affect SMEs, the Recovery Loan Scheme, which replaced the Covid loan guarantee scheme, has been renamed the Growth Guarantee Scheme and extended until the end of March 2026.

The scheme offers a 70% government guarantee on loans to SMEs of up to £2 million in Great Britain and £1 million in Northern Ireland.

He promised businesses he would introduce permanent full expensing on leased assets “as soon as it is affordable”.

Among key measures affecting consumers, Hunt confirmed he would consult on reforming child benefit to apply to collective household income, rather than on an individual basis, aiming for change by April 2026.

Meanwhile, he has raised the single income threshold – after which child benefit must be repaid – from £50,000 to £60,000. He said this meant 170,000 families would not need to make repayments. Benefit will not need to be repaid in full until earnings reach £80,000.

Hunt extended the freeze on alcohol duty and on fuel. He said the latter meant an average £50 saving for consumers next year.

A “British ISA” allowing up to £5,000 a year investment in UK equity was also unveiled.

Hunt said predicted inflation was 11% when he came to office. The prediction was now below 2%, “a whole year earlier than forecast in the Autumn Statement”. “That didn’t happen by accident,” he said.

On growth, Hunt said the watchdog Office for Budget Responsibility expected 0.8% this year and 1.9% next year – 0.5% higher than forecast in the autumn. “Because we have turned the corner on inflation, we will soon turn the corner on growth,” he said.

Sign up for weekday travel news and analysis straight to your inbox

Gary Noakes

Supplier Directory

Find contacts for 260+ travel suppliers. Type name, company or destination.