Long time, no see: what Tui needs to do to win over independent agents

TTG Staff

TTG StaffWith 1.1 million extra seats to fill from the UK next summer, the heat is on for Tui to try to regain its top position by charming independent agents

Like a family member reappearing after a dispute long ago, Tui will soon be knocking on doors of independent agents it has not spoken to for years.

Overtures follow Tui’s realisation it must fight off Jet2holidays and the rapidly-growing easyJet holidays, both darlings of the independent agent. Tui lost its title as the UK’s largest operator by Atol size to Jet2 earlier this year, and has 1.1 million extra seats to fill next summer as it tries to regain ground.

Tui may be the biggest in-house travel retailer but, with 320 shops, its high street presence wanes in the face of Hays Travel’s 450 and Advantage Travel Partnership’s 750. Tui is opening shops – seven so far this year and three imminent – “with more to be announced”, but it needs third-party help.

ENGAGEMENT TEAM ASSEMBLE

In June, Richard Sofer, Tui’s UK commercial and business development director, told TTG the brand wanted to sell more through independents to “redress the balance” of recent years.

A 14-strong trade engagement team is being assembled, including five trade relations managers – but how well will it be received, and what will Tui offer?

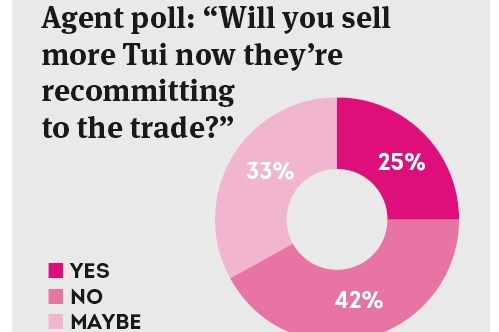

Tui will not say what percentage of its sales are via independents, and there is some suspicion about its olive branch. More than 40% of respondents to a snap poll of TTG’s agent readers said it wouldn’t see them sell Tui more; a third said they’d consider it, and only a quarter said they would sell more.

The findings appear to align with agent sentiment. “The frustration independent agents have had with Tui for years is that we can’t compete with their online prices, and it’s just not worth it to us to cost-match them,” said Westoe Travel director Graeme Brett. “If they’re genuinely going to do this, then it needs to be a serious investment in independent agents and come with worthwhile commission and price parity.”

Oasis Travel’s Sandra Corkin is more blunt: “Over the years, one minute they are working with the trade and then the next minute they’re not.”

ISSUES TO OVERCOME

Assuming Tui addresses price parity and commission issues, what will it offer agents in terms of product and where will it seek their help?

Manchester has been Tui’s biggest summer departure point since 2018, accounting for a quarter of its seats this summer – 1.2 million – according to data firm Cirium. Manchester has overtaken Gatwick at just over one million, followed by Birmingham (772,000) and Bristol (354,000). It’s worth noting too that Birmingham will become an easyJet base from next summer.

With three of its 19 airports accounting for 61% of Tui flights, it is doing okay in these areas. But in places like Aberdeen, Belfast, Norwich, Bournemouth and Exeter, it could do better. Plus, at airports including East Midlands, Newcastle and Birmingham, where summer 2023 capacity increases range between 23 and 48%, it needs more agent backing.

Tui has unique attractions that may sway independents. Several mid- and long-haul destinations are big sellers, something Jet2holidays and easyJet holidays cannot match. Tui has grown Cape Verde into a year-round beach destination and is opening Senegal for winter sun using partner hotels.

It is a big operator to the Dominican Republic too, boasting 58 properties there, and offers Aruba via its own charter. Mexico and Jamaica, with big capacity hotels, are other Tui favourites, and Goa is offered with direct Tui flights.

Marella Cruises is another Tui draw, with cruising not a Jet2holidays or easyJet holidays option, while another big Tui brand bonus is its 134 exclusive hotels, particularly the Tui Blue for Families properties.

While cruise and long-haul are useful segments for agents, many rely on mid-price short-haul for the bulk of their sales. “Tui’s offering is very similar to easyJet holidays,” said Thorne Travel director Shona Thorne.

However, she is supportive: “I never shut the door on anyone if I can avoid it. It’s a service some of our customers like.” Thorne added margins remained an issue: “At this stage, it’s not a product I would be supporting a huge amount.”

Idle Travel director Tony Mann is another sceptic. “It would take a long, long time for me to be confident they won’t be disappearing two minutes down the line or undercutting us,” he said. “I don’t remember having any relationship with Tui. Jet2holidays is probably the best tour operator we’ve worked with in 39 years in terms of the support they give us.

“We sell Tui holidays and cruises, but a relationship is something a company builds over time with things like marketing support, etc. We’re nowhere near that with Tui.”

Some, though, are pragmatic. “I won’t ignore them because that’s not the right thing for us and for our clients,” said Jennifer Lynch, general manager of ArrangeMy Escape. “I’d still be a bit sceptical to start and maybe grow Tui business over a long period of time – but they need to stop discounting direct.”

Tui will soon find out if the latter outweighs the attractions of its unique hotels and destinations for independent agents – those tricky conversations with the AWOL relative are about to begin…

Sign up for weekday travel news and analysis straight to your inbox

TTG Staff

Supplier Directory

Find contacts for 260+ travel suppliers. Type name, company or destination.