Chancellor spells out National Insurance reform and freezes business rates

Gary Noakes

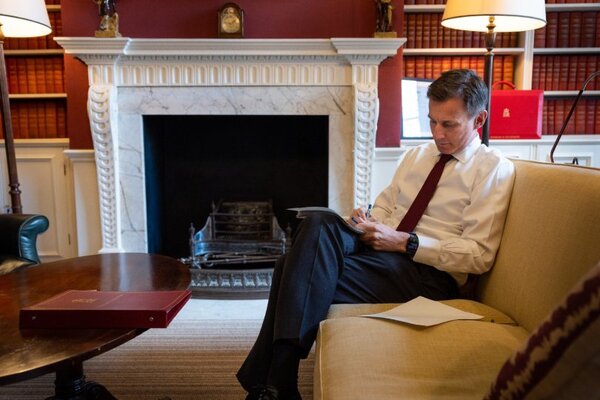

Gary NoakesChancellor Jeremy Hunt has outlined reforms to National Insurance and business investment in his autumn statement, but there was also good news for those with retail premises.

On business rates, Hunt said he would freeze the small business multiplier for another year and extend the 75% business rates discount for retail, hospitality and leisure for another 12 months. “I recognise the role of pubs and high street shops in our communities,” Hunt said.

Abta chief executive Mark Tanzer said: “The extension of business rates support will benefit many travel agents and it’s encouraging that the government has listened to our calls in that area.

“While travel has seen a good recovery since the pandemic, many businesses still see the impact of Covid on their balance sheet as they face large debt repayments.

"This continued support will help companies as they continue to recover, especially as businesses are operating against the backdrop of high inflation and increased costs.”

Hunt also unveiled what he described as "the largest-ever cut to employed and self-employed National Insurance". From 6 January, the 12% NI rate will fall to 10%, which Hunt said meant an extra £450 a year for someone on an average £35,000 salary.

The self-employed will see further cuts to their NI payment with the abolition of Class 2 NI, currently a flat rate £3.45 a week. However, this funds state pension entitlement, so many may choose to pay the £192 a year. “Those that choose to pay voluntarily will still be able to do so,” Hunt said.

In addition, Class 4 payments, currently 9% for the basic rate taxpayer, will be cut to 8% from April, saving an average £350 a year for a self-employed person.

For companies, the business investment "super reduction" that allows firms to write off the cost of investment against tax is to be made permanent. This means that for every £1 million of investment, companies can recoup £250,000 against tax. Hunt called it “the biggest tax cut for business in modern British history".

There was some consolation for pensioners battling soaring cost of living and energy bills. Pensions will rise by 8.5% from April 2024, meaning up to £900 a year more, with the basic rate increasing to £221.20 a week.

Hunt also confirmed the National Living Wage would be raised from £10.42 an hour to £11.44 from April 2024, a rise of almost £1,800 a year. It will also be expanded to 21 and 22-year-olds for the first time.

The government said this would help almost three million of the UK’s lowest paid workers, but it means a wages bill increase of 9.8% that employers will have to foot.

The Advantage Travel Partnership said there were different rates of pay for apprentices depending on age and the year of the apprenticeship. "From our reading, those who are 21 and over who are apprentices and have completed their first year of training will be entitled to the National Living Wage come 1 April 2024," it said.

"However, apprentices under 21 years old, or who have not completed their first year of training, will not be entitled to the National Living Wage, and will instead be entitled to the apprenticeship wage or the minimum wage, depending on their age."

Hunt said difficult decisions to put the economy back on track had worked, “rather than recession, the economy has grown”, he said.

UK economic growth has been faster than the Euro area, he said, with 0.6% growth this year and 0.7% next year predicted by the Office for Budget Responsibility. The OBR predicts inflation will fall to 2.4% by the end of next year.

’Step in the right direction’ or ’missed opportunity’?

In a joint response, Advantage and Aito said: “We welcome the key points announced as part of today’s Autumn Statement.

“Anything which reduces the tax burden on businesses and puts more money back in the pockets of consumers is good news for businesses operating in the UK outbound travel sector and for those servicing businesses with travel management solutions. The measures announced today are a step in the right direction.

“We also welcome the government’s continued support for small business and high streets, in particular the business rates support package announced today by the chancellor.”

UKinbound chief executive Joss Croft, though, described the statement as a "missed opportunity", one that "failed to harness the substantial economic growth potential of the UK’s inbound tourism industry" and "disregard the sky-high price of international travel".

“The UK is at a significant competitive disadvantage but with the right support from government, international tourism to the UK could immediately and significantly boost businesses and local economies throughout the four nations," said Croft.

“The failure to bring back VAT refunds for international visitors is a significant oversight and one that will hit UK high streets and boost those in France, Germany and Italy."

Sign up for weekday travel news and analysis straight to your inbox

Gary Noakes

Supplier Directory

Find contacts for 260+ travel suppliers. Type name, company or destination.